Form 10B: Applicability, Due Date, and Filing Process

What is Form 10B?

Form 10B is an audit report provided by a CA under Section 12A of the Income Tax Act, 1961 to charitable funds, universities, educational institutions, hospitals, or other medical institutions whose total income in the previous financial year has crossed the threshold of Rs.5 crore.

What is the applicability for filing Form 10B?

It is mandatory for every organization or trust registered under Section 12 to furnish Form 10B in certain cases. Some of these are as under :

- the total income of such fund or institution or trust or university or other educational institution or hospital or other medical institution exceeds Rs. 5 crores during the previous year; or

- such fund or institution or trust or university or other educational institution or hospital or other medical institution has received any foreign contribution during the previous year. In this case, even unregistered trust etc. must also file form 10B.

- such fund or institution or trust or university or other educational institution or hospital or other medical institution has applied any part of its income outside India during the previous year;

Due Date of Form 10B?

This form is to be filed one month before the due date of ITR. For AY 23-24, the due date has been extended to 30 Nov, 2023.

How to file Form 10B?

You can fill and submit Form 10B through the following method:

Step 1: Log in to the e-Filing portal with valid CA credentials.

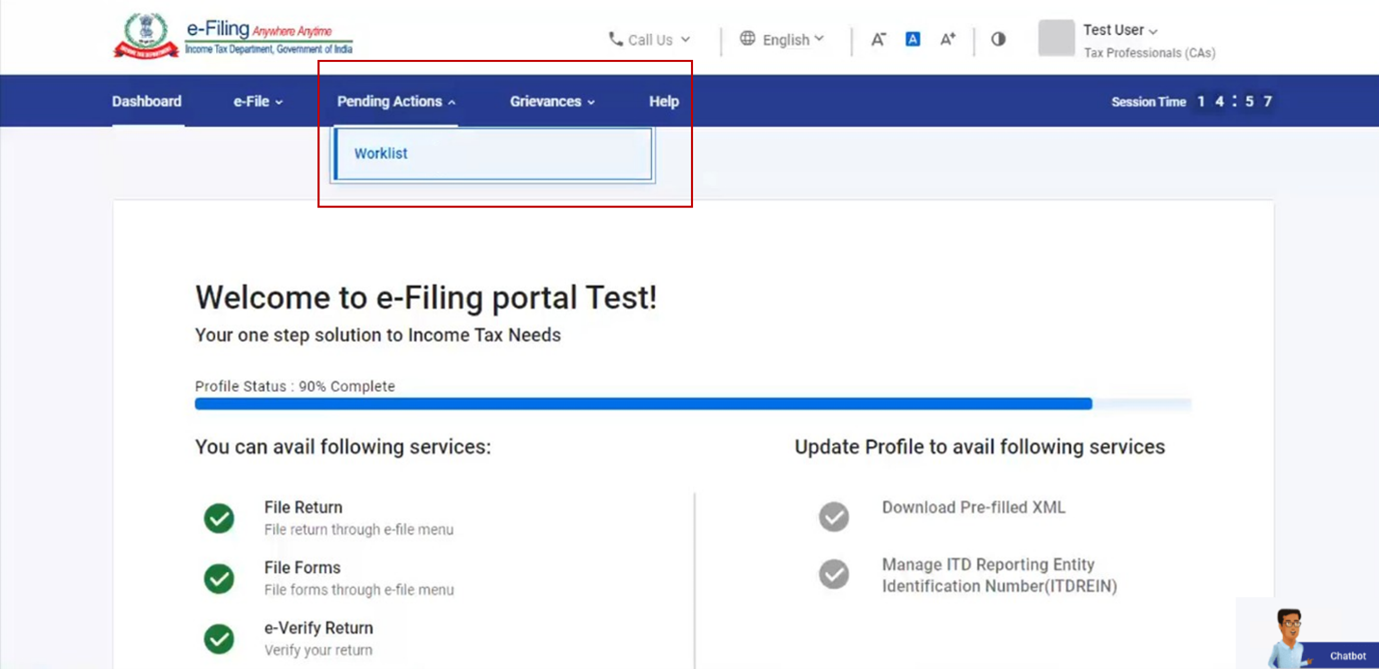

Step 2: Click Pending Actions > Worklist to view all the forms assigned to you by taxpayers.

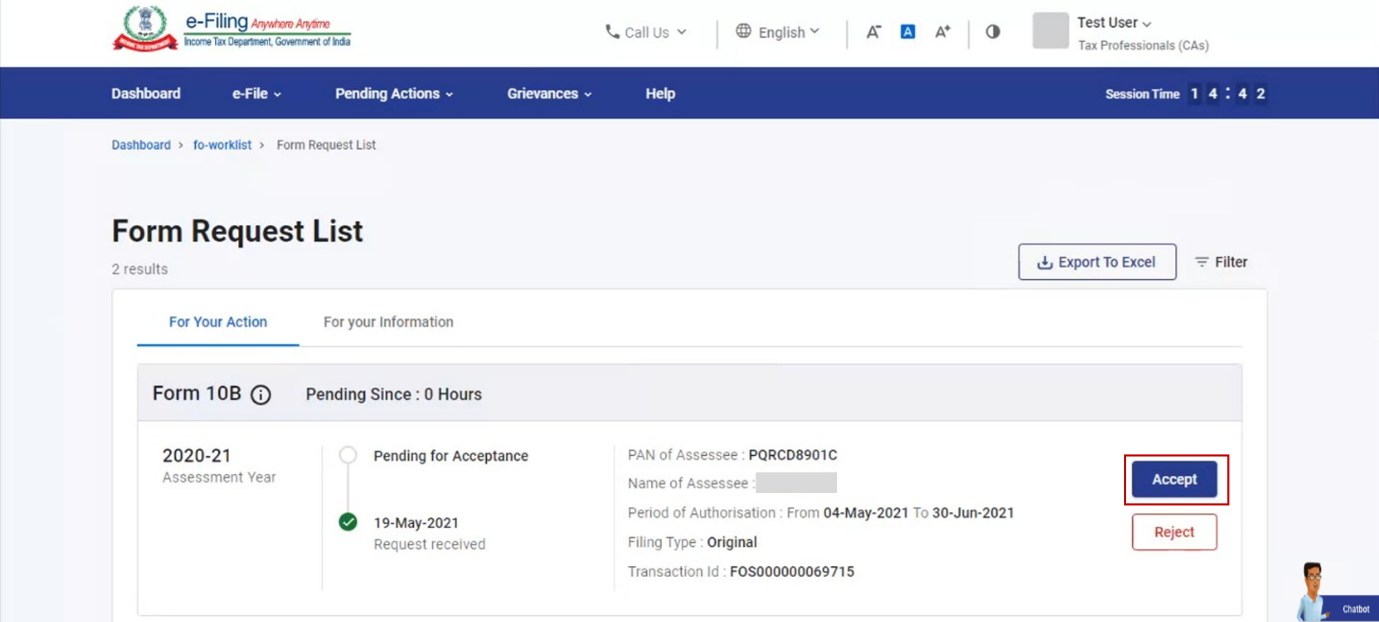

Step 3: You can accept or reject (by providing a reason that will be sent to the taxpayer) the forms assigned to you. Accept Form 10B from the list against the relevant taxpayer.

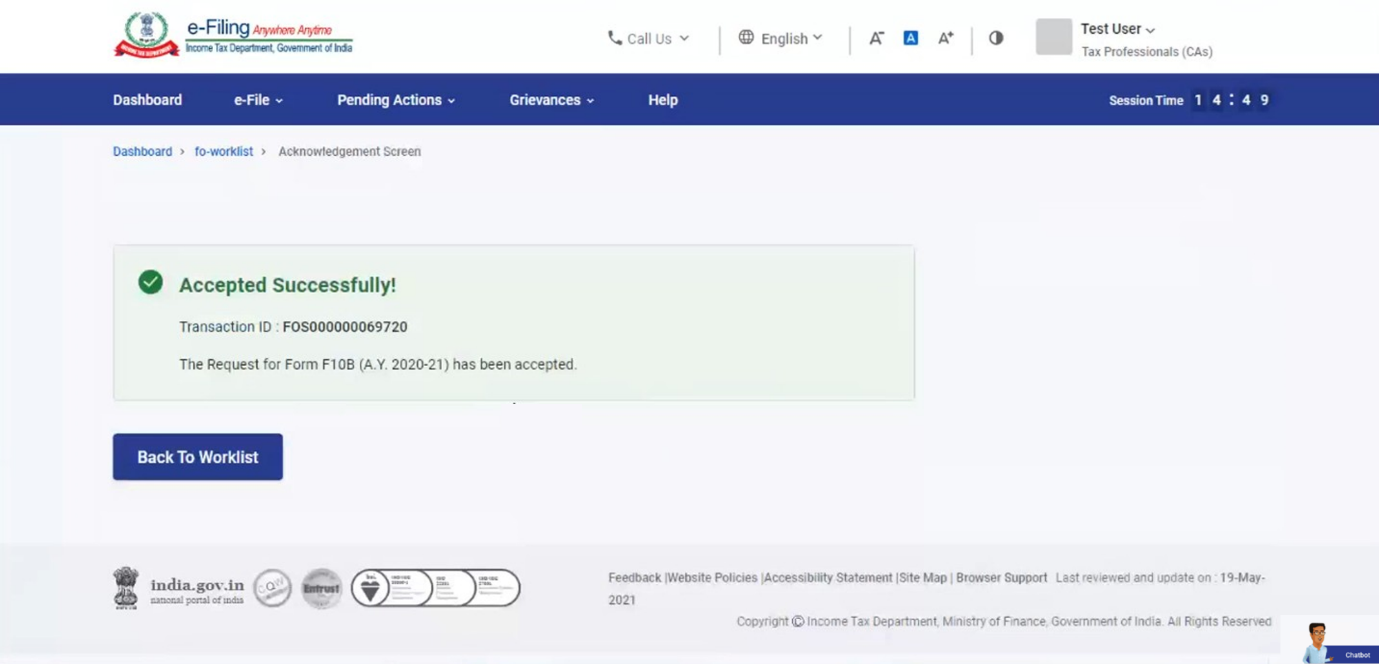

The accepted successfully message is displayed.

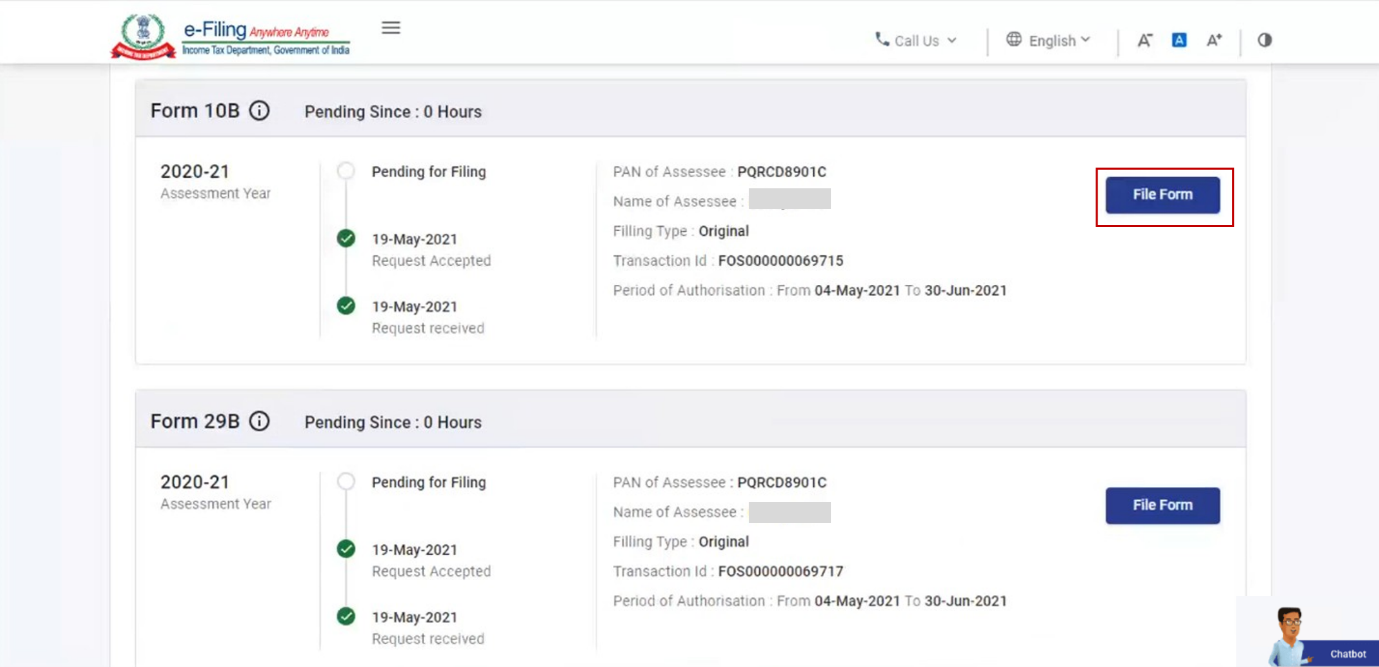

Step 4: In the Worklist, click File Form against Form 10B.

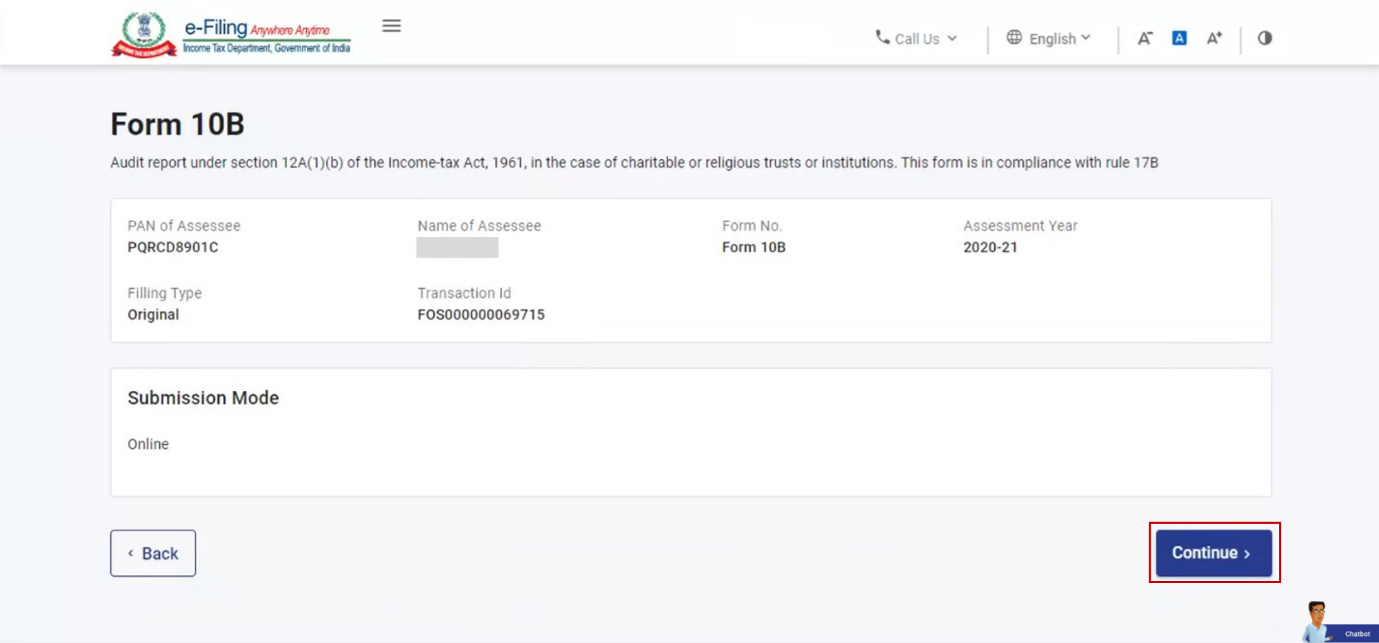

Step 5: Verify the details and click Continue.

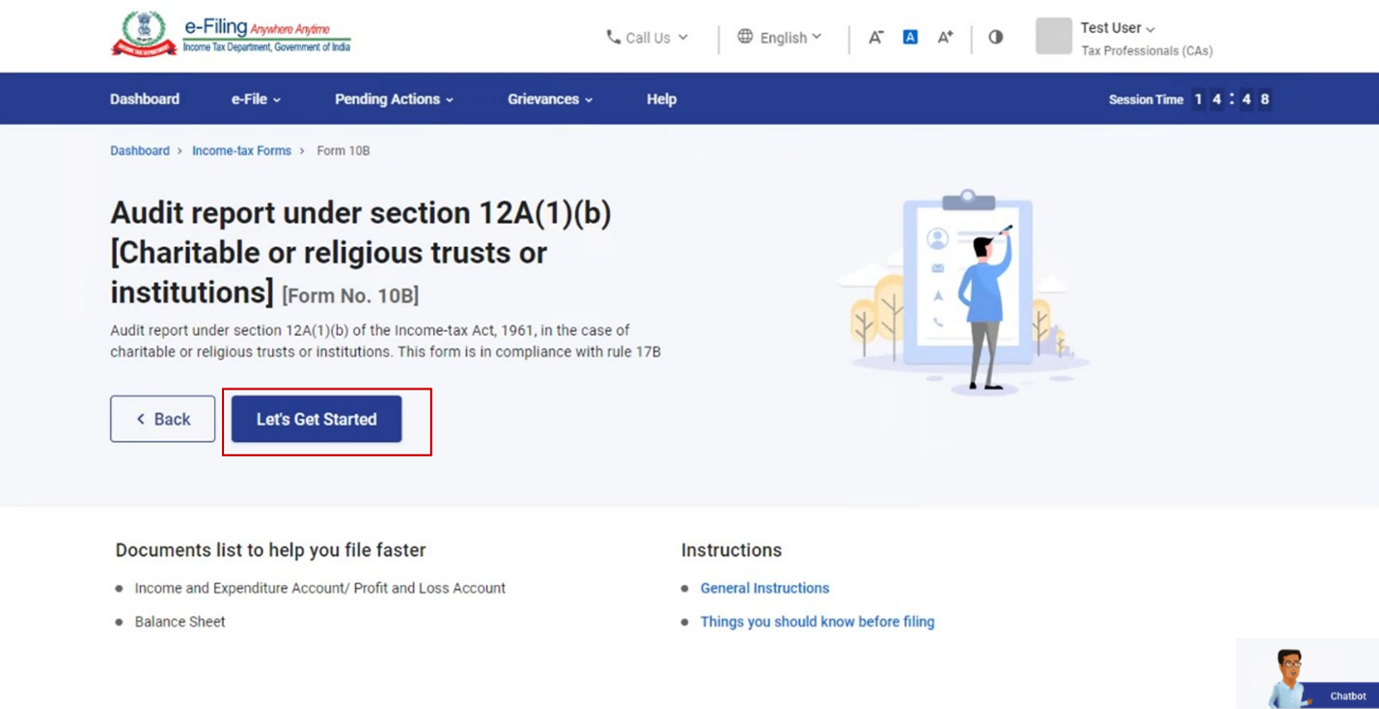

Step 6: On the Instructions page, click Let's get Started.

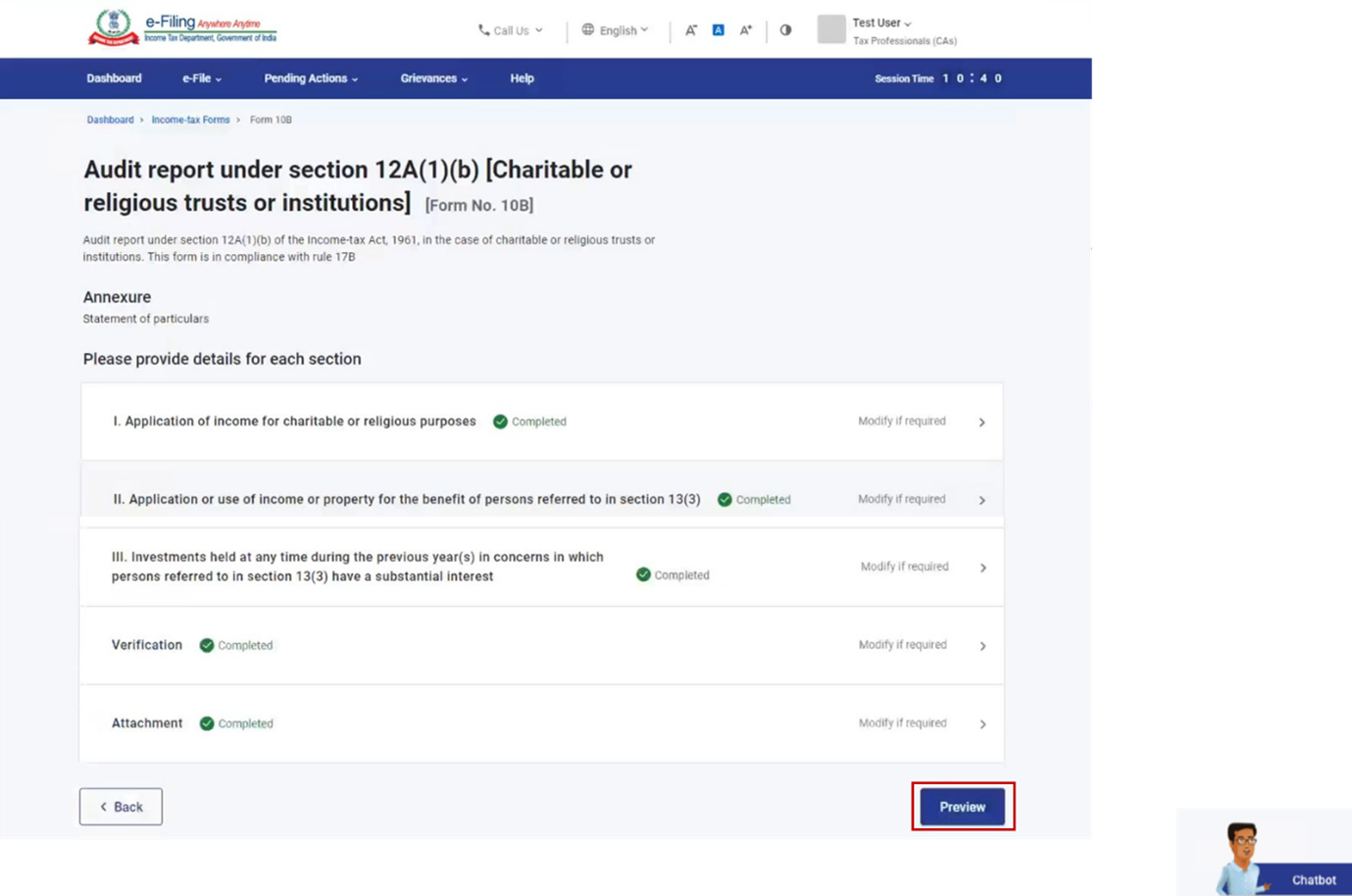

Step 7: Fill all the required details and click Preview.

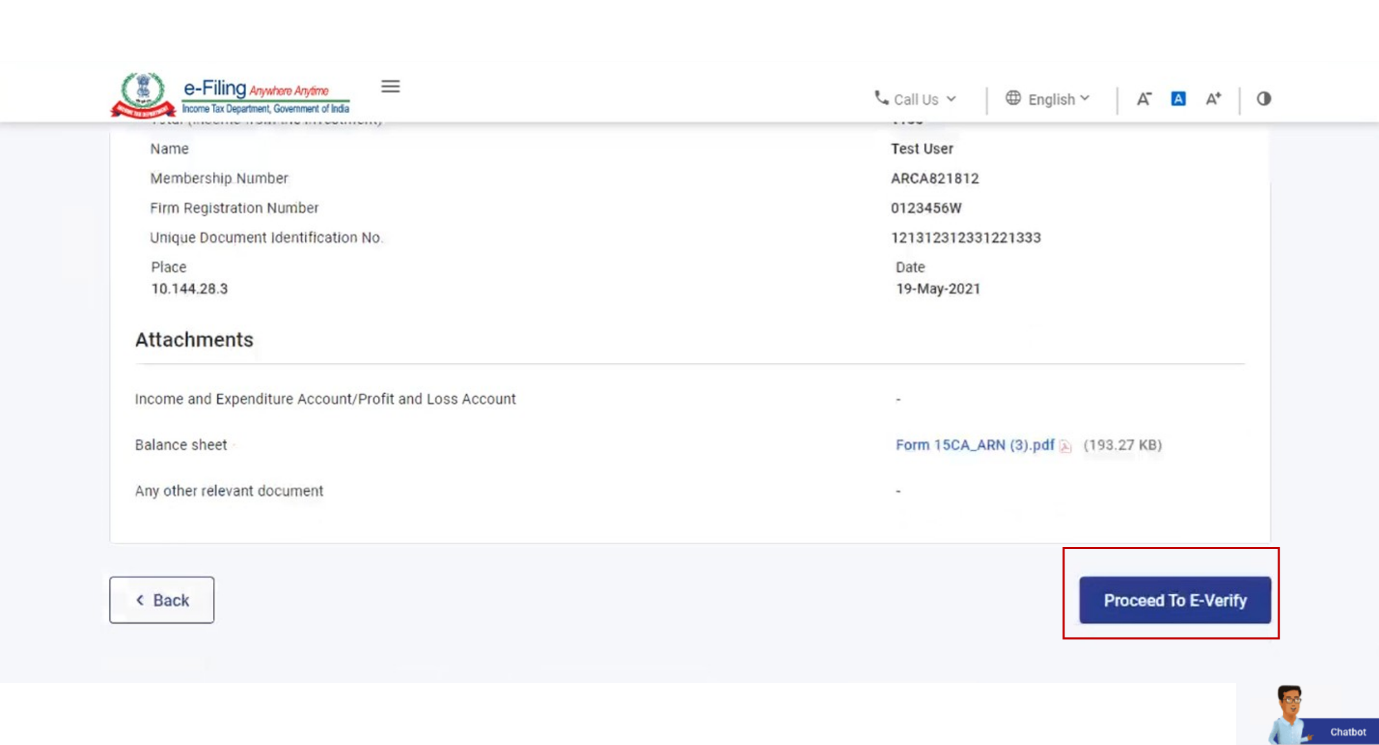

Step 8: On the Preview page, click Proceed to e-Verify.

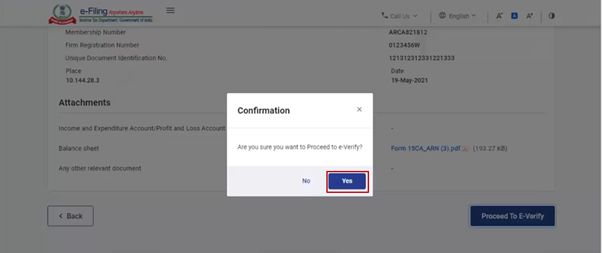

Step 9: Click Yes to submit.

On clicking Yes, you will be taken to the e-Verify page. Verify the form using DSC.

On successful validation, email and SMS communication is sent to the taxpayer who can further accept or reject Form 10B