UAE's E-Invoicing Journey: A Data Dictionary to Standardize Digital Transactions

The UAE is taking significant strides towards a fully digitized tax system, and a key update has recently been released, the e-invoice dictionary. This initiative is part of the broader "We the UAE 2031" vision, aiming to enhance government performance and strengthen the UAE's digital infrastructure. The Ministry of Finance (MoF) is actively gathering feedback from businesses and e-invoicing service providers to refine the proposed elements of the UAE e-invoicing framework. This collaborative approach ensures transparency and alignment with industry needs, setting the stage for a smooth transition to e-invoicing.

Think of the data dictionary as a structured catalog of data elements for creating, exchanging, and processing e-invoices. It's a foundational reference for businesses, software developers, and regulatory bodies. Standardization is crucial for ensuring consistency across different document types, which is essential for the smooth integration and processing of e-invoices within the business ecosystem.

The consultation period aims to:

- Establish a common understanding of data elements used in e-invoices across business communities.

- Understand the practical requirements of businesses, identifying any gaps or additional data fields necessary for operational, regulatory, or analytical purposes.

- Obtain diverse perspectives from industry experts, accounting firms, and e-invoicing service providers to create a holistic and widely accepted e-invoicing framework.

Key Points

- Mandatory e-invoicing: Initially, the UAE’s e-invoicing system will focus on business-to-business (B2B) and business-to-government (B2G) transactions. The MoF may expand this to include business-to-consumer (B2C) transactions at a later stage. The e-invoicing process will be mandatory for all business-to-business (B2B) and business-to-government (B2G) transactions, regardless of the VAT registration status of the entities involved.

- E-invoice defined: An e-invoice is a structured digital document exchanged electronically between a supplier and a buyer, with data reported in real-time to the UAE Federal Tax Authority (FTA). Unstructured formats like PDFs, Word documents, images, scanned copies, and emails do not qualify as e-invoices.

- Timeline: E-invoicing is scheduled to roll out in phases starting in Q2 2026.

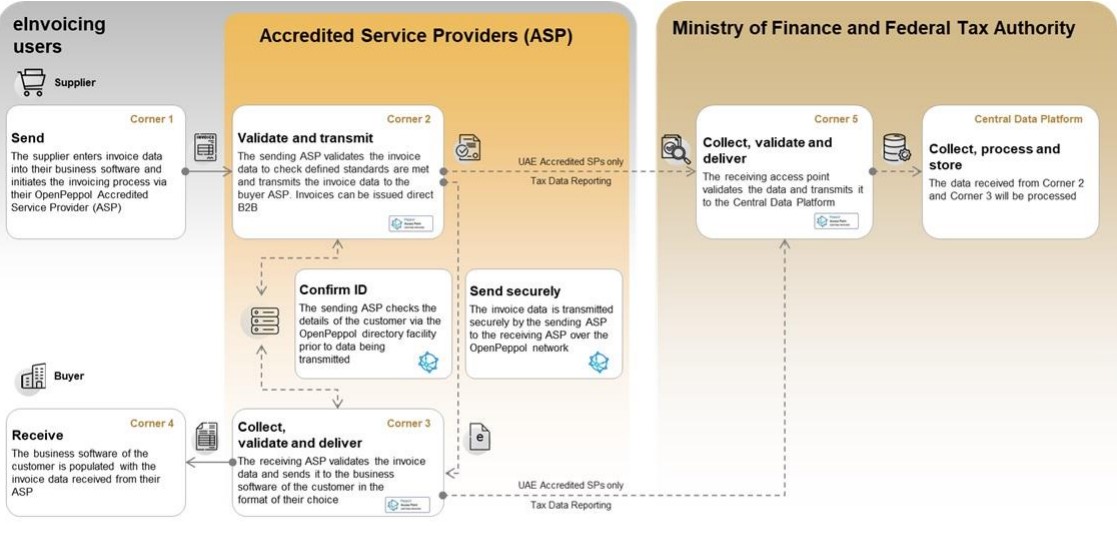

- The 5-corner model: The UAE’s e-invoicing system adopts the Peppol "5-corner" model, ensuring secure and standardized exchange of invoices between businesses and the FTA.

The UAE's e-invoicing framework mandates that all businesses, regardless of VAT registration status, adopt electronic invoicing to streamline VAT processes and reduce the cost of invoice processing. This framework utilizes a Decentralized Continuous Transaction Control and Exchange (DCTCE) model, leveraging decentralized technologies to enhance efficiency, security, and transparency. The e-invoicing process involves Accredited Service Providers (ASPs) who validate and convert invoices into the UAE's standard XML format. Suppliers submit e-invoice data to their ASP, who then transmits it to the buyer's ASP. In parallel, tax data documents (TDDs) are reported to the Federal Tax Authority (FTA). Message Level Status (MLS) updates are exchanged between ASPs and the FTA to confirm successful processing and reporting. A critical component of this system is the Data Dictionary (PINT AE), a standardized catalog of all data elements used in e-invoicing, ensuring consistency and interoperability across the ecosystem.

Data Dictionary & Its Practical Application through Use Cases

Data dictionary (PINT AE) serves as a foundational reference for businesses, software developers and regulatory bodies to ensure consistency and compliance in e-invoicing systems. This reinforces as a single eligible source comprised of all data elements, ensuring everyone’s involved understanding. The concept of ‘use cases’ defined as the scenario where e-invoicing is required. It outlines common use cases for generating invoices and credit notes in the UAE, listing scenarios like standard tax invoices, reverse charge mechanisms, zero-rated supplies, and exports, among others.

Each use case contains mandatory fields which are required to be completed. Hence, the complete version of data dictionary also included optional and conditional fields. Mandatory fields are as follows:

Also, when it comes to data dictionary content in XML format it varies based on the type of invoice. Standard tax invoice & commercial tax invoice.

Stakeholder’s Feedback

Notification reflects on consultation process for refining the e-invoicing Data Dictionary within the UAE's e-invoicing program. The focus is on gathering stakeholder feedback to ensure the Data Dictionary is comprehensive, clear, and practical.

Key Areas for Feedback:

- Comprehensiveness: It emphasizes the need to include all essential fields for various e-invoicing scenarios, covering core elements like invoice numbers, dates, buyer/seller details, item descriptions, tax information, payment terms, and totals. It also seeks input on whether the dictionary adequately addresses general use cases (discounts, multi-currency transactions) and incorporates industry-specific data elements. Stakeholders are directly asked if any fields are missing for their specific business needs and if there are conflicts with existing fields. It is noted that HSN (HS Code) and service codes will initially be optional but will become mandatory later, asking stakeholders about the practical reporting limits (4, 6, or 8 digits) for these codes.

- Clarity: The document stresses the importance of clear and unambiguous definitions for each data element, ensuring all stakeholders, regardless of technical expertise, can understand them. It provides an example of defining "Invoice Date" explicitly. Stakeholders are asked to identify any confusing terms or fields with multiple interpretations.

Stakeholders are provided with a timeline with a document release date and a deadline for feedback submission. It specifies a submission process, requesting stakeholders to provide their name, company, contact details, industry, and annual turnover. This information will be used to assess the impact of any raised issues and facilitate further discussions. A table is included to collect specific questions and corresponding responses regarding comprehensiveness and clarity.

In essence, this is a call to action for stakeholders to actively participate in shaping the e-invoicing Data Dictionary, ensuring it meets the diverse needs of businesses and contributes to a successful e-invoicing ecosystem in the UAE.

Conclusion

As the UAE embarks on its e-invoicing journey, the introduction of the e-invoice dictionary marks a pivotal moment in the evolution of tax compliance and digital transactions. By prioritizing standardization and collaboration, the Ministry of Finance is ensuring that all stakeholders are equipped to navigate this transition effectively. The phased rollout of mandatory e-invoicing, starting in July 2026, will enhance VAT compliance, streamline processes, and foster transparency in financial operations.