-

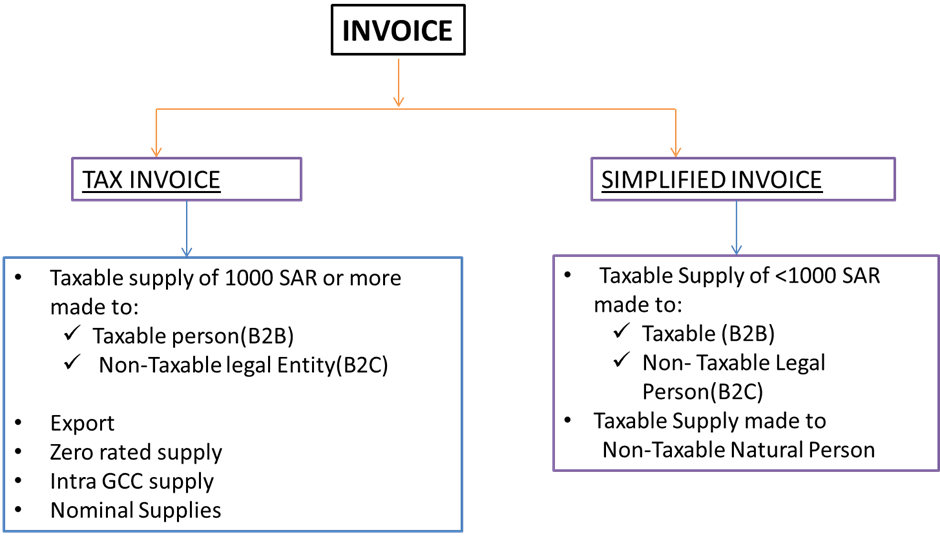

When to issue a simplified e-invoice (or note) vs a standard e-invoice (or note)?

When invoicing a non-taxable natural person (other than for the export of goods), you have the option to issue a simplified invoice. However, when you are invoicing a non-taxable legal entity, you may issue a standard tax invoice.

-

Is there any data residency or data center legal requirement?

As per Article 66 in the Implementing Regulations of the Value-Added Tax Law, if a cloud e-invoicing solution or a cloud data center situated outside the kingdom is utilized, it is necessary to have an extension or access to data within the branch located in the kingdom. This access should enable the retrieval of all associated records. Furthermore, the taxpayer entity may also be subject to non-tax-related regulations from authorities like the National Cybersecurity Authority and the National Data Management Office, as per their respective published laws and any other applicable regulations or controls.

-

Do I have to issue an electronic invoice if I receive an advanced payment from my client?

In accordance with Paragraph (1) of Article 53 of the VAT Implementing Regulations, receiving an advance payment should lead to the issuance of an electronic invoice.

-

If a VAT-registered Saudi Company issues an invoice to a non-resident foreign company, what is the e-invoice generation mechanism?

In the context of exports, it is a requirement to generate an electronic invoice in compliance with the E-invoicing Regulation.

However, for imports, it is important to note that they are typically not subject to the E-invoicing Regulation.

-

Can a different invoice reference number format be used for government-issued invoices, Riyadh branch invoices, and other branch invoices?

You, according to Paragraph (5/b) of Article 53 of the VAT implementing regulation, it is indeed a requirement for an invoice reference number to be visible on the invoice in order to identify the tax invoice. The regulation does not specify a specific format for this number.

As long as the chosen format uniquely identifies the tax invoice, taxpayers are allowed to use different formats for the invoice reference number. This provides some flexibility for businesses to implement their own systems for numbering and referencing tax invoices.

-

What are some examples of e-invoicing systems?

An efficient and compliant solution for generating and issuing e-Invoices is Webtel’s e-Invoicing software.

- ZATCA listed e-Invoicing Vendor

- Seamless Integration with ERPs

- 100% compliant with ZATCA requirements

- Pdf/A3 with embedded XML e-Invoices

- Fast & Secure e-Invoicing Software

To know more about Webtel’s e-Invoicing Software, visit: Fast & Reliable ZATCA e-Invoicing Software

-

Do we need to issue invoices on sample products to customers?

A nominal supply, as defined, doesn't arise from an actual transaction of goods or services to another person but is treated as a taxable supply for VAT purposes based on specific circumstances, such as providing goods or services for no consideration.

For nominal supplies, an e-invoice is required to be generated and retained in the business records for audit purposes. However, it's important to note that the recipient of goods or services under a nominal supply arrangement will not be able to deduct input VAT related to that nominal supply. As a result, the e-invoice for a nominal supply is typically not provided to the recipient, as there is no input VAT deduction available to them.

This is a common practice in VAT systems to ensure that input tax deductions are limited to transactions where the recipient is entitled to recover the VAT.

-

If the e-invoice is generated in Webtel’s solution, is it okay to keep the existing format inside our ERP archive?

Yes, you can utilize your existing e-invoicing solution to maintain archival in accordance with the ZATCA (Zakat, Tax, and Customs Authority) guidelines.

-

Our e-invoice solution provider generates its own Unique no. Will that be considered invoice No in filing returns?

A tax invoice is typically required to include a sequential number that uniquely identifies it. In some cases, a unique number generated by an e-invoice solution provider can be considered as the invoice number, as long as it meets the requirement of being sequential and unique. It's important to ensure that the numbering system complies with ZATCA regulations and guidelines.

-

We have an in-house customized ERP for invoicing. Can Webtel help us and guide us on how to integrate with ZATCA servers?

Webtel's e-invoicing solution offers the flexibility to integrate with various in-house ERP (Enterprise Resource Planning) or POS (Point of Sale) systems. If you require additional information or have specific integration needs, you can contact Webtel by reaching out to us at +91 7303393220

-

Is Phase 2 just a technical integration between our system and ZATCA, or does it require any business process-wise change?

Phase 2 involves the integration of taxpayer systems with ZATCA's (Zakat, Tax, and Customs Authority) system for e-invoicing. During this phase, applicable taxpayers are required to use e-invoicing solutions to ensure that each invoice is approved by ZATCA. This integration will have a substantial impact on various aspects of your invoice generation process, including printing invoices, presentment, reporting, auditing, and VAT filing.

If your existing e-invoicing system is not "Phase II ready," this means that it may not be compliant with the requirements of this integration phase. In such cases, both business and IT teams must collaborate to implement the necessary changes to ensure compliance with the regulations and successful integration with ZATCA's system. It's important to be prepared for the process-wise changes and adjustments required to meet the Phase 2 e-invoicing requirements.

-

Carriers leaving the plant will require an invoice. How do we provide them?

In the context of electronic invoicing, the clearance process ensures that each electronically generated invoice is reviewed and validated by the relevant tax authority before it can be shared with the buyer. This clearance is essential to establish the legal and valid status of the electronic invoice.

The clearance process typically follows a real-time transaction integration model, where the taxpayer, after generating an electronic invoice, directly sends it to the tax authority for validation before sharing it with the buyer. The tax authority then performs validation checks on the invoice across different categories and varying levels of detail. If the invoice is approved and compliant with the applicable regulations, it is stamped by the authority to indicate its validity and then returned to the taxpayer. This process helps ensure the accuracy and legality of electronic invoices in compliance with tax laws and regulations.

-

Can the e-Invoicing Solution by Webtel be integrated with SAP ECC 6.0?

Yes, we Webtel’s e-Invoicing Software can be integrated with SAP ECC 6.0. Our solution can be integrated with any ERP or POS system.